"This is a deep consolidation designed to make your pants poop and to inflict maximum pain on traders. $47,000 could still kill more bulls, but accumulation seems to be underway," he stated.

He attributed some of the decline to selling pressure from the German government and Mt. Gox's redemption, but added that it is not only these two factors. He stated that Bitcoin miners are still capitulating, and added, "The local environment is bearish until hash rate climbs higher, as evidenced by a belt-shaped recovery. Miners are selling, as happens after each halving."

The average hash rate is currently around 600 EH/s, a drop of about 18% from the historical high in May.

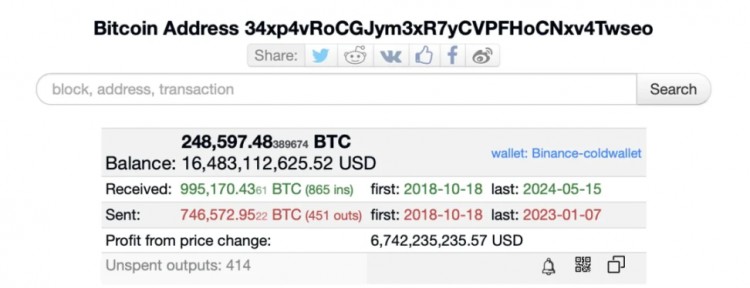

Woo's insights offer a comprehensive view of the current supply and demand dynamics in the Bitcoin market.